Ways to Donate

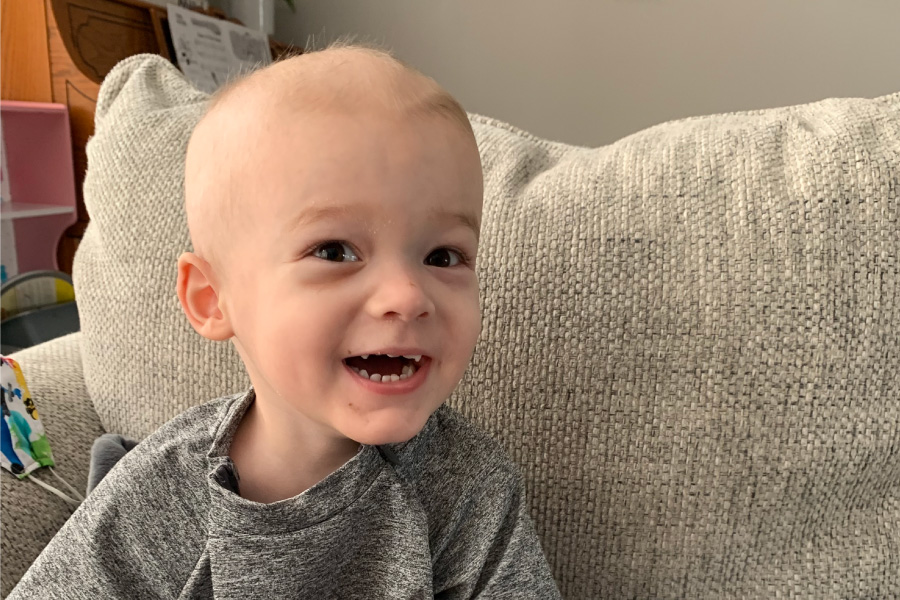

Your gift is a lifeline for kids facing cancer.

Donate today to help provide better, safer treatments and cures for children battling cancer.

Why support CCRF?

Our unique approach to funding research and support programs makes us the organization where your donation, big or small, will stretch as far as possible. We believe that a world without childhood cancer is possible. Since 1981, supporters have contributed over $300 million to accelerate research, create awareness and support families impacted by childhood cancer. Learn more about what we fund.

Here are some ways you can donate to make a difference.

Monthly giving

Set up a monthly recurring donation by checking “make this a monthly gift” on our donation form. You can change the amount of your gift or cancel at any time by clicking here.

Give over the phone

Call us at 1-888-422-7348 during regular business hours and a member of our staff will help you donate over the phone.

Mail a check

Check this off your to-do list. Make checks payable to Children’s Cancer Research Fund and mail to: 1650 W 82nd St., Suite 400, Minneapolis, MN 55431.

Manage or change your donation in our donor portal

To update your name and contact information, manage or change your credit card and payment information, please visit our donor portal using the email you donated with.

Make your gift a tribute. Give in honor or in memory of someone.

Funding childhood cancer research is an incredible way to show you care. To give online, use our donation form and check the box to indicate your gift is in honor or in memory of someone. If you would like us to notify someone about this honor or memorial gift, there is a place to provide that information.

You can also start a fundraiser in honor or in memory of someone, which is an easy way to share your fundraising and encourage others to donate. Learn more about fundraising pages here.

Even More Ways to support

Planned Giving

Leave a gift to CCRF in your will. Our team can ensure your planned gift is unique to you and the things you care about, and help you make an impact well into the future.

Start a Fundraiser

Celebrate a milestone, honor a loved one or start your own virtual event with our easy-to-use fundraising tools.

If you have fundraised and would like to send in cash/check donations, click here

Employee Gift Matching

Many companies have programs that support employee giving. Click here to find out how you can double your donation by asking your employer to match it.

Donor Advised Funds

Giving through a donor advised fund gives you the flexibility to recommend how much and how often you give to CCRF, and it allows your money to grow tax-free.

Donate Stock

To give stock shares to Children's Cancer Research Fund, please inform your broker of the following: they should transfer the stocks to Charles Schwab DTC#0164, account #4818-0452, and contact Ben Olson at Guardian Wealth Strategies at 952-746-1743 or ben@gwealth.com.

Give Tax-Free with an IRA

If you are 70 ½ or older you can give up to $100,000 through your IRA directly to a charity without having to pay income tax on that money. Because CCRF is tax-exempt, every cent of your gift will help further our cause.